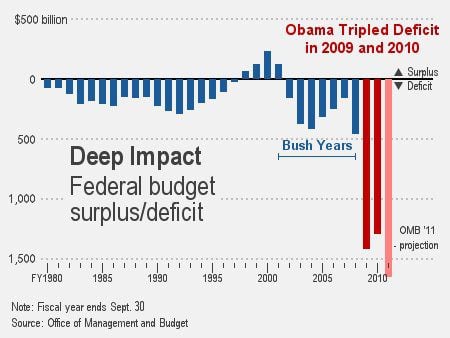

Looking at the first chart, you will see four years of positive revenues just right of center line on the chart. The first three were Clinton numbers, his last three years. The fourth, of course, belongs to Bush. Take a careful look at the chart. Forget all that Democrat/Obama nonsense of Bush spending 1.2 trillion dollars. Didn't happen.

Understand that I not drawing these conclusions. The first chart comes from the Office of Management and Budget and, the second is a compilation of Congressional Budge Office numbers and White House projections. These are "official" numbers.

TARP was signed into law on October 3, 2008, the third day of fiscal year 2009. "TARP" stands for Troubled Assets Relief Program. Not a single dime of this money was spent on "troubled assets." All of the money was redirected to the mortgage industry. In addition, according my research, more than 3 trillion (with a "t") was channeled through this bill in terms of securities guarantees and the like as well as shadow banking bailouts (to the tune of as much as 36 trillion dollars). Again, all of this benefited the mortgage/banking industry. None of it shows up on any report or charted summary. "Shadow banking?" This is the unregulated world of the banking system. It would not be wrong to call it "shadowy banking," but most of us conservatives shy away from such "name calling."

The nation’s deficit fiscal year 2009 was between $1.412 trillion and $1.985 trillion, depending on which chart you reference. This included unpaid TARP expenditures. Understand that you can read 10 articles about the size of that net debt and you will receive 10 different answers. I know, I have done the research. This was Obama's first year in office. To be fair with The Slickmeister, of the 1.412 trillion dollars in debt, as much as $700 billion was TARP money. If we exclude that from the total for 2009, we have between $712 billion and 1.1 trillion in debt, again, depending on which chart is reference. Compared this to Bush's last year debt of just under $500 billion, his largest debt total.

Fiscal year 2010, Obama's second year, saw a 1.293 trillion dollar deficit.

The U.S budget deficit for fiscal year 2011 is $1.299 trillion, the second largest shortfall in history. It represents a quadrupling of government expense measured against any of the Bush years.

I do not count TARP in my numbers. Obama does (at times) , but charges the entire $700 to fiscal year 2008 and George Bush. That is patently unfair in view of the fact that Obama - out of the other side of his mouth - has often claimed all of the TARP was paid back. If that is true, no point in counting it, is there?

The second chart, similar in its formatting, is the product of the Congressional Budget Office, different from the OMB.

The two chart comparison illustrates my complaint. It seems that on every occasion an analysis is made, we have different numbers. Maybe not radically so, but different, nonetheless.

There can be no question as to TARP and this second chart. It is definitely counted into fiscal year 2009, as is the case with OMB chart, but the bottom line totals are not the same as we compare the two charts; $1.412 trillion versus $1.85. The CBO chart is significant, however, in that it gives us the White Estimate deficit (the light red [pink?] bars. If TARP was $700 billion, according to the CBO chart (our second chart) , Obama spent 1.25 trillion WITHOUT COUNTING TARP into the deficit total. Notice that by 2011, the fiscal year that just ended, the Obama brain trust, geniuses as they are, projected a deficit of "only" $900 billion instead of the 1.299 just reported.

Conclusions:

Bush spent more than any previous presidents, but not "trillions" each year, as has been the case with Obama. In fact, Bush's largest deficit was $490 billion in 2008 (fiscal year). contrary to the lies being told by the Democrat/Obama Administration. Again, these are not my facts, they are government facts.

Obama's 2011 deficit, the second highest in history, was $300 billion lower than OMB estimates but $400 billion higher than White House projections.

No comments:

Post a Comment